Warren Buffet and James J. Hill – two tycoons of American industry who lived a hundred years apart. Yet they had something in common.

In this article, I explore the connection between one of the greatest capitalists of our time, Warren E. Buffet, and railroad magnate and “Empire Builder” James J. Hill.

The Manitoba

James Jerome Hill, born in 1838, was one of the leading railroad executives of the Gilded Age in the United States. He and his business partners purchased the St. Paul and Pacific Railroad. From this fledgling railroad they formed the St. Paul, Minneapolis and Manitoba Railway Co. often called the “Manitoba”. James J. Hill became general manager. Once in control, he focused on building a reliable and efficient railroad system to serve the St. Paul area and the burgeoning Northwest.

Unlike many other railroad tycoons of the time, he had no intention of speculating with his stock. Instead, he worked tirelessly to make his railroad the most efficient carrier of goods and people in the region. He personally oversaw the construction of new lines and the continual improvement of existing ones. He demanded that grades be improved and curves straightened wherever possible.

His legacy was: Build an impressive railroad network that could move large quantities of goods in the most efficient way:

“What we want, is the best possible line, shortest distance, lowest grades, and least curvature we can build.”

By having the most efficient network, he could offer lower prices than competing railroads and thus prevail in the face of fierce competition.

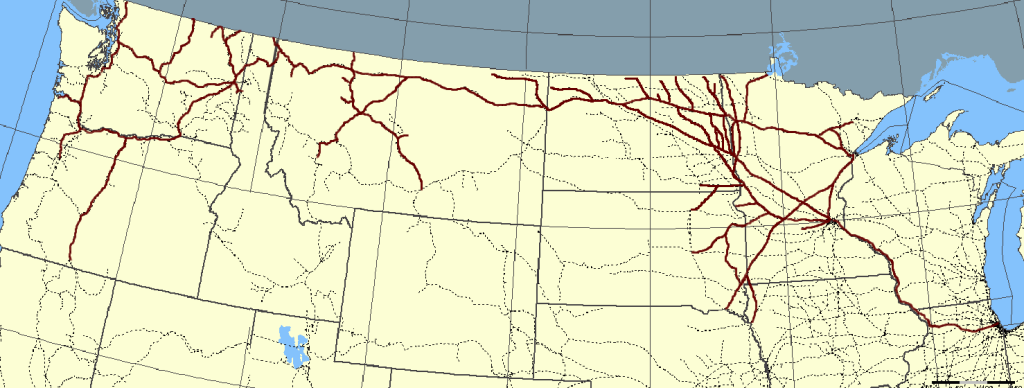

This cost advantage also gave him the capital to expand his railroad in ways that seemed impossible in the beginning. The Manitoba grew from a regional railroad to one of the few transcontinental railroads. James J. Hill saw this growth as fundamental, foreseeing a time when the many railroads in the U.S. would begin to consolidate and merge into larger and larger systems. And he wanted his railroad to be at the forefront of that process, rather than a junior partner to be acquired by a larger railroad.

Other transcontinental railroads of the time, such as the Union Pacific or Southern Pacific, were hastily built to take advantage of the land grants the government provided as an incentive. This meant that these lines were not very well built, nor did the companies have sufficient funds to make the improvements that would lower transportation costs like the Manitoba did.

The philosophy of relentless focus on efficiency and transportation capacity made the Manitoba successful and James J. Hill a very rich man.

The Manitoba was later renamed the Great Northern Railway. Eventually, the wave of mergers that James Hill foresaw began, but not until long after his death. In 1970, the GN and three other railroads formed the Burlington Northern Railroad. Later, BN acquired the Santa Fe Railroad, resulting in the name Burlington Northern and Santa Fe, or BNSF for short. This was the last wave of mergers, and you can still see this name on locomotives throughout the western United States.

The names of the Manitoba and the Great Northern have long been forgotten by the general public, remembered only by a few railroad buffs.

But I wondered, did the legacy of James J. Hill that defined his company live on after all these mergers?

Warren Buffet

Fast forward to 2009. Berkshire Hathaway, the investment vehicle of Warren Buffet and Charlie Munger, announces that they are buying BNSF outright. They pay $34 billion for the rest of the shares they do not already own. This was the largest acquisition in the history of Berkshire Hathaway and also the first time that one of the major Class I railroads was completely taken over by another company outside the railroad industry.

In his letters to shareholders in 2009 and 2010, Warren Buffett gave several reasons for buying a railroad. One reason was that they were looking for a way to invest the large amount of cash that Berkshire Hathaway had. And they invested it in rail because they saw a bright future for this already quite ancient mode of transport:

“Both of us are enthusiastic about BNSF’s future because railroads have major cost and environmental advantages over trucking, their main competitor. Last year BNSF moved each ton of freight it carried a record 500 miles on a single gallon of diesel fuel. That’s three times more fuel-efficient than trucking is, which means our railroad owns an important advantage in operating costs.”

Economically, the purchase made a lot of sense at the time, and the decision has proven to be a very wise one. Since 2009, BNSF has returned much more cash than it cost to acquire.

Still, one question intrigued me: Why did Warren Buffet choose BNSF and not one of the other Class I railroads that were publicly traded in 2009? I could find no quote from Warren Buffet explaining his reasons for choosing BNSF over Union Pacific, Kansas City Southern, Norfolk Southern, or CSX. Nor could I find an article that examined the question.

Then I had an idea: What if Warren Buffet thought the same way James J. Hill had a hundred years earlier? That the best railroad was the one that could move the most traffic at the lowest cost? I was sure that Warren Buffet thought that way. But how could I prove it?

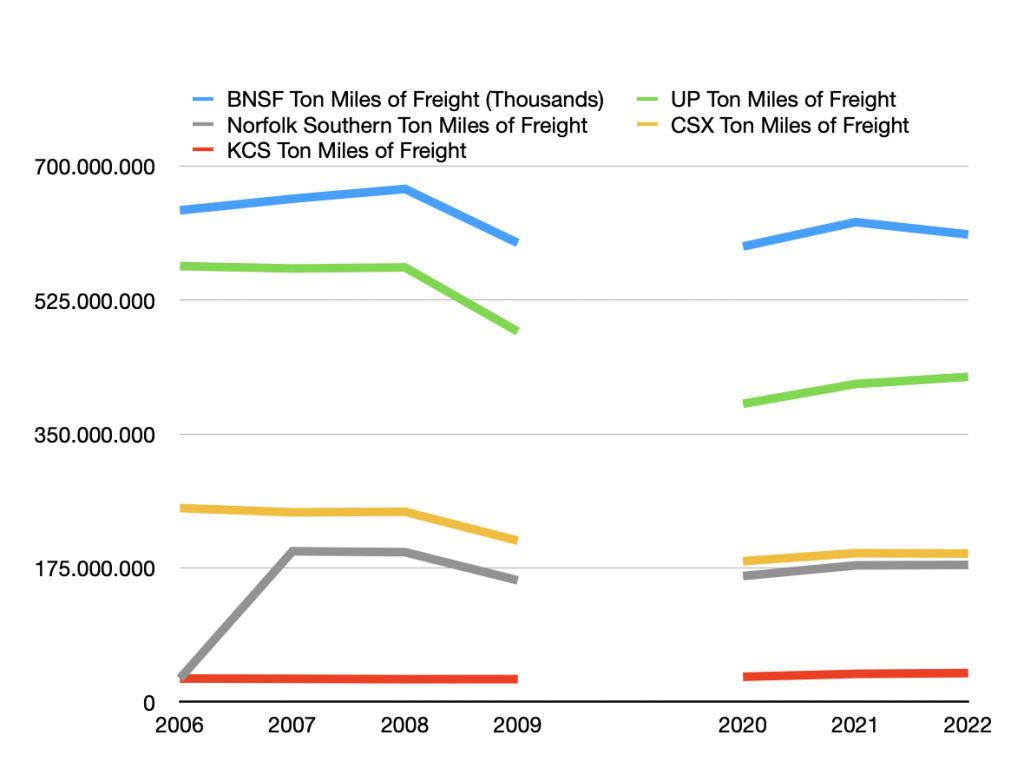

So I started a little research project. I tried to answer the question: How could I compare the efficiency of the Class I railroads? And would BNSF come out on top? Because if it did, that might at least partially explain Warren Buffett’s decision back in 2009.

Fortunately for me, all railroads in the United States are required to report statistics about their operations to the Surface Transportation Board (STB). They have to file what is called the R1 report once a year, and the STB makes it available on their website.

In these reports I was able to find the numbers I needed. Out of the big pile of numbers you can find there – everything from the amount of track laid in a year to details of shares in other companies – there are two numbers that are relevant to this investigation:

The first number is “ton-miles of freight”. This is the total amount of freight and how far it was moved by the railroad. In my opinion, this is the best number to show how much the railroad can move, regardless of the type of freight or the origin and destination.

The second number is the amount of fuel needed to provide that capacity.

I have collected these numbers for all five Class I railroads over the past few years, and also from 2006 to 2010, the period when Berkshire Hathaway purchased BNSF, and thus probably the numbers that Warren Buffet considered in his decision.

If we look at the first number, ton miles of freight, we can see that BNSF is by far the largest freight carrier of all 5 railroads.

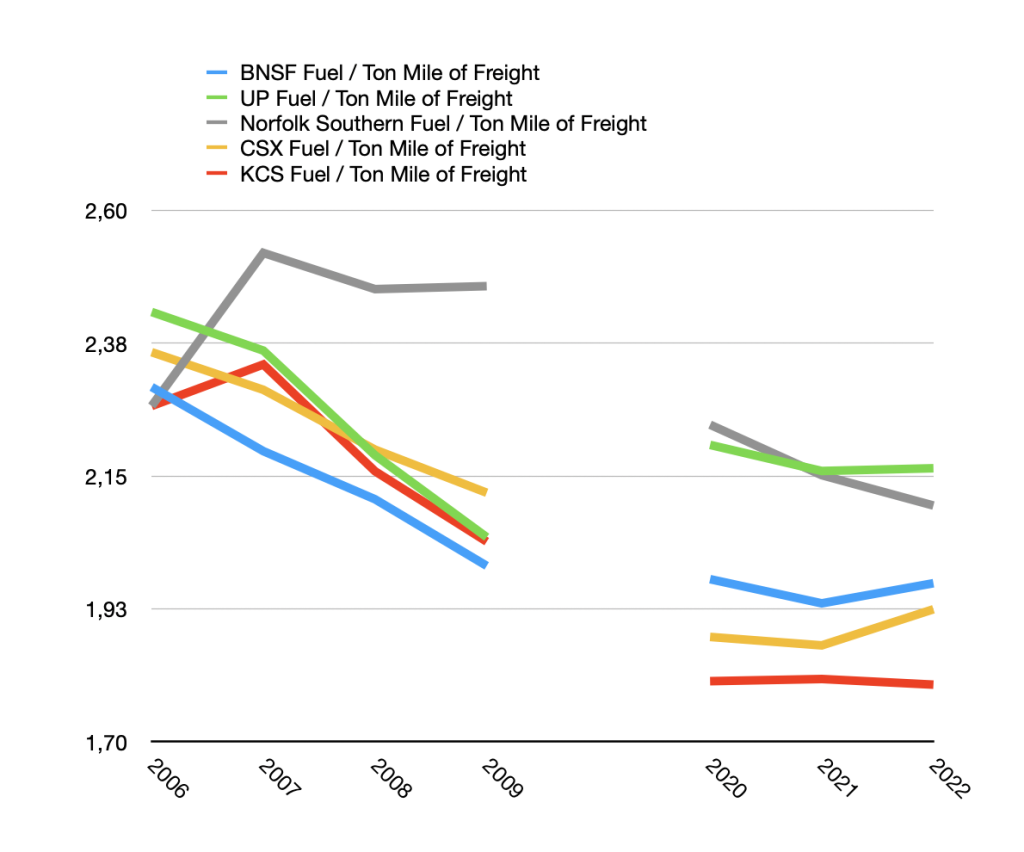

It gets even more interesting when we look at the relationship between the hauling capacity of railroads and their fuel consumption.

In this chart, we can clearly see that BNSF also had the lowest fuel consumption per ton-mile shipped during the period from 2006 to 2010. This means that at the time of the acquisition, BNSF was not only the largest, but also the most efficient railroad in the entire United States!

Although Warren Buffett did not say it outright, I believe this is the reason he decided to buy BNSF and not another railroad.

With the largest and most fuel-efficient railroad in his portfolio, Warren Buffet is now in the perfect position to benefit from both an increase in traffic in the U.S. and an increase in fuel prices, because an increase in fuel prices would hit competing railroads and trucks even harder than BNSF and thus bring in even more business.

We can also see that all railroads have become more efficient since 2010, and CSX and NS are now even more efficient than BNSF. Still, BNSF is much better than its main competitor, UP, which serves the same region.

Conclusion

A railroad that can move large amounts of freight with the least amount of fuel, resulting in lower prices for shippers and better returns for investors. This was the legacy and dream of James J. Hill.

The railroad he built was the embodiment of his vision. Even though it merged with other railroads along the way, the numbers show that this vision lives on in BNSF long after his death. And that vision made BNSF the perfect investment for another titan of industry nearly a hundred years later.

Although James J. Hill and Warren Buffett never met, they seem to have been like-minded managers and investors. I am sure they would have gotten along well.

I think we can learn from this story what is important when trying to build a transportation system that serves both your customers and your investors well.

Sources

Michael P. Malone: James J Hill, Empire Builder of the Northwest

Ralph W Hidy et al: Great Northern Railway: A History

Berkshire Hathaway, Letters to the Shareholders (link)

Surface Transportation Board, Annual Reports (link)