In part 3 of my series of articles, we will extend our example of double-entry bookkeeping and look at some more types of accounts that can appear on your balance sheet.

Automating the Transactions

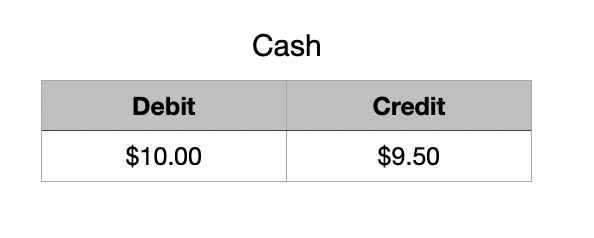

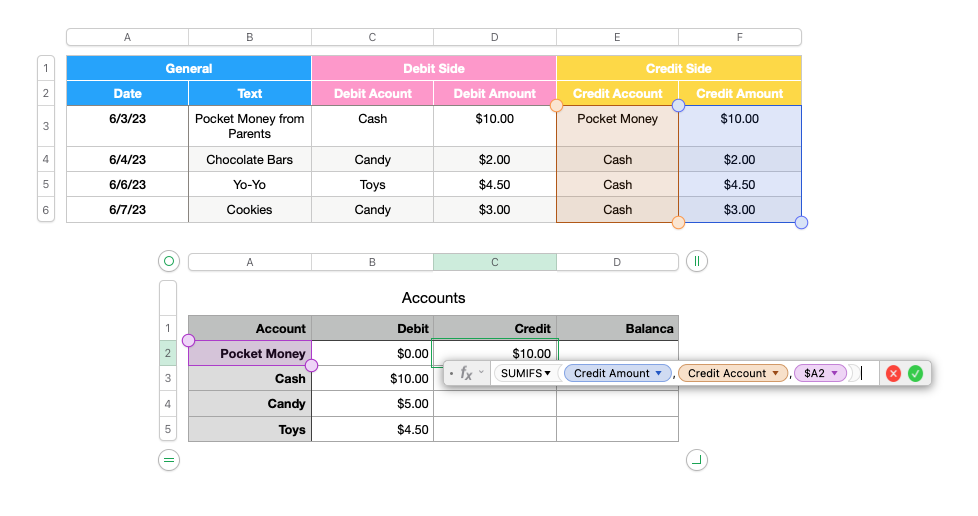

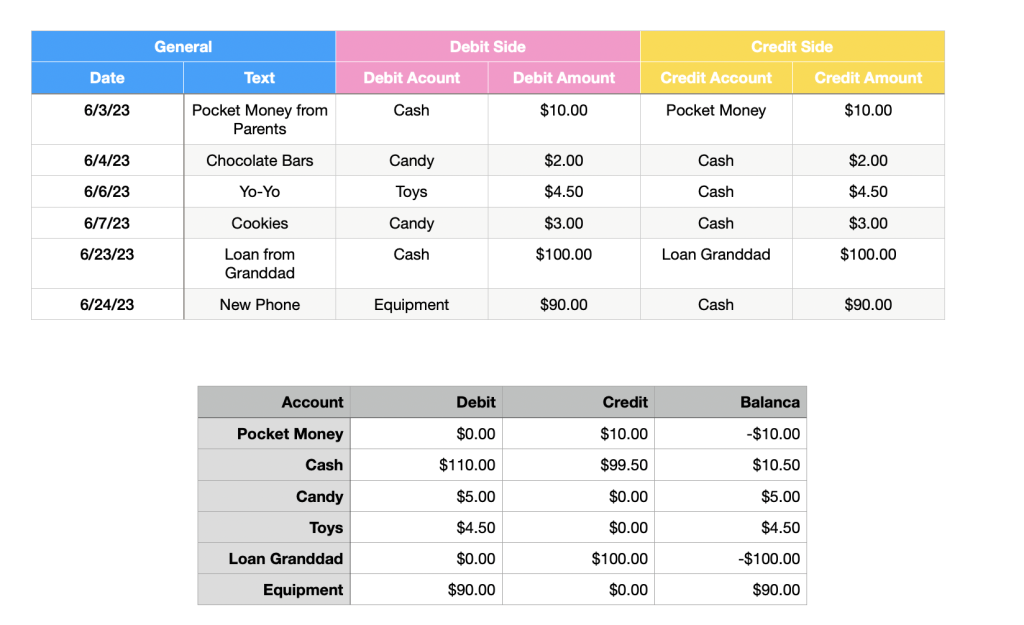

Before we start adding more accounts, I would like to show you a trick to further automate these entries. So far, for each account, we have created a new table showing its balance, like this:

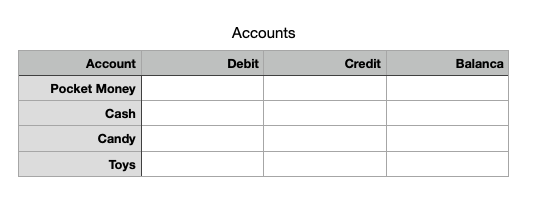

This can be done much more quickly in Numbers. The trick is to put all the accounts in one table and put the account name in the first column, like this

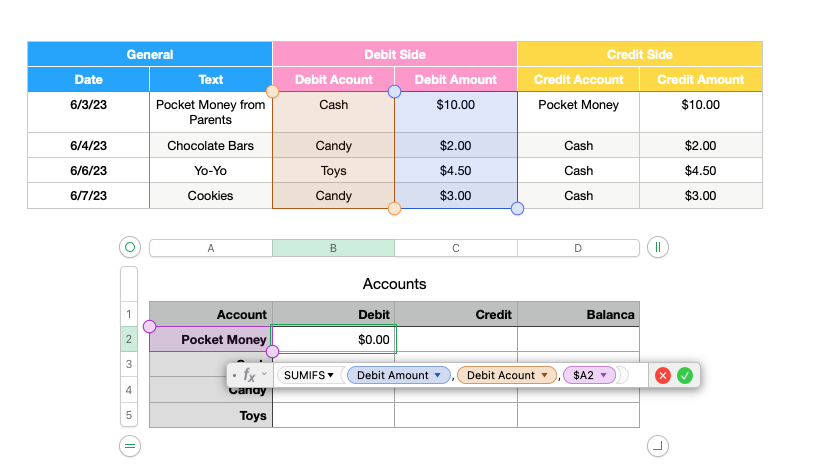

Next we need to bring in our formulas again.

We know that the way the accounts are handled is always the same, only the name of the account is different. But the name of the account is now in the first column, so we can use it in our formula. Let’s have a go and fill in the Debit field for the Pocket Money account first:

Here you can see our formula “sumifs” again. It looks the same as in the first article, except that the last parameter, “condition”, has been replaced by the field A2. This is the reference to the first column containing the account name.

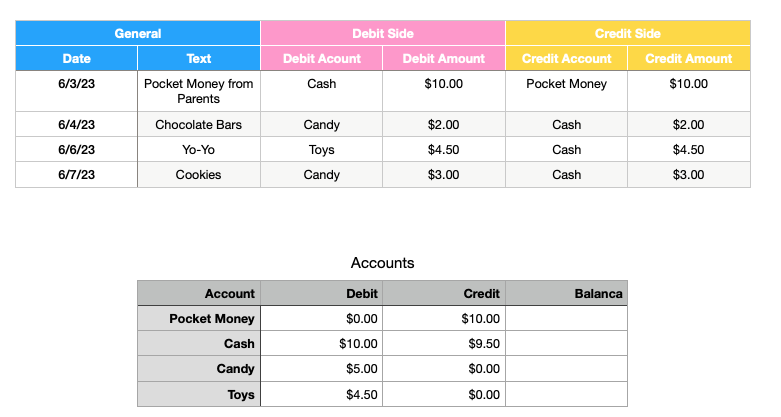

The total debit for the Pocket Money account is $0.00, as expected. Now for the magic. We can use the auto-fill feature of Numbers to automatically fill in the rest of the column. We grab the little yellow handle at the bottom of the cell and drag it all down to the bottom of the column, like this

Now we have an easy way to fill in our accounts.

Let’s do the same with the credit column. Here you can see the new formula

Again, we can drag this cell all the way down to fill the other cells. The result will look like this

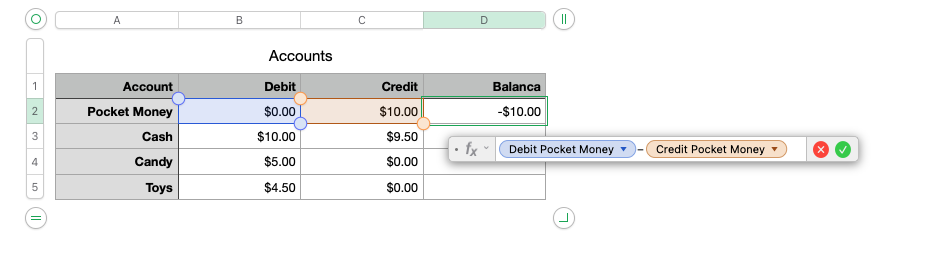

Finally, we can calculate the balance using the simple formula we already know:

Here we go! All the accounts in one table, all automatically calculated.

And one more thing: adding a new account is now very easy. You simply add a new row by dragging the little icon in the bottom left corner of the table. This adds a new row to the table and the formulas are already there. All you need to do is add the name of the new account in the first column and your new account is ready.

We now know how to add a new account in just five seconds. Let’s use our new-found powers to add a few more accounts to our example.

Starting a Business

Remember our example from the first chapter? You are a kid who wants to buy toys and sweets. But the pocket money you get from your parents is not very generous, at least not generous enough to fulfil all your wishes. You decide it is time to earn some extra money. Then you can buy more toys, maybe even a new Xbox.

You start to think about how you can earn some extra money. You could do some morning rounds as a paperboy. Or you could sell home-made lemonade. But no, that is so 20th century! Today’s cool kids make money online. You decide to make it big on TikTok.

You need a smartphone to record videos and upload them to TikTok. But you don’t have one yet and you don’t have enough money to buy one.

So what are you going to do?

You ask your parents to lend you some money, but they do not believe in your business model. But your grandfather is open to your ideas. He is willing to lend you $100 on the condition that you visit him once a month to report on your progress.

No problem! You take the money and, being a diligent accountant, record it.

Your cash balance increases, so cash goes on the debit side. What goes on the credit side? We need to create a new account for this loan. Let’s call it Loan Grandpa.

With our new trick, this account will be added very quickly:

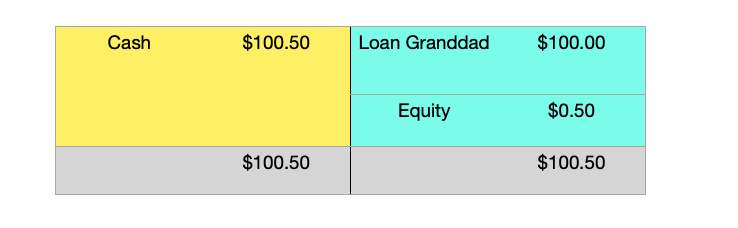

Where do we put this new account on your balance sheet? You may remember from Chapter 2 that liabilities go on the right-hand side, along with equity. So let’s do it:

Now you can see the loan you got from your grandfather on the right. Your right side totals $100.50. Your cash has also increased by $100, bringing the total on the left to the same amount. Everything is still in balance, as it should be.

Your First Equipment

Armed with your “venture capital”, you can now go shopping for your mobile phone. You quickly realise that a hundred bucks is not going to get you the latest and greatest. An older model will have to do, but as long as it takes video, it should be good enough.

You convince your grandfather to take you to the flea market. You find a phone in your price range, and after a little bargaining, you can take it home for just $90!

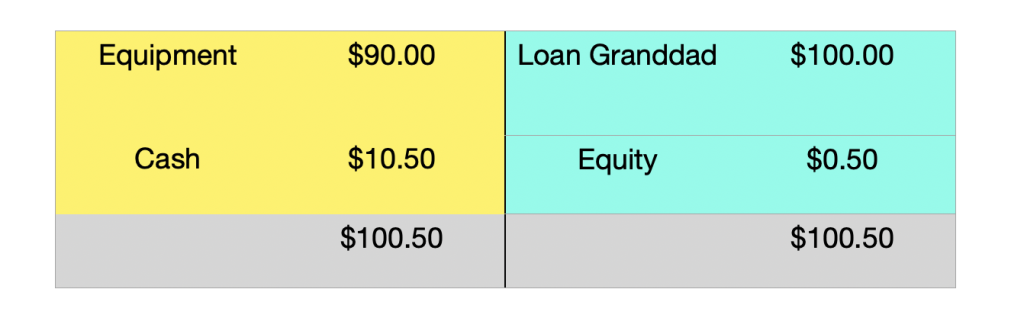

How do you account for this? You could write this off as an expense, but you are a businessman now, and businesses show their equipment assets on their books. Equipment is something that will earn you money in the future, so when you buy it, you put it on an asset account. This way your capital does not decrease when you buy something. Over time, an asset depreciates and this is shown in the books as depreciation of an asset over time. But you have just started your business and your assets have not yet depreciated. So let’s put your new phone on an account called Equipment:

And we can put the new asset on the balance sheet. Where do we put it? We put it above the cash account. Accountants like to classify assets and liabilities according to their liquidity. The more liquid assets like cash or current accounts go at the bottom, the less liquid ones like equipment go at the top. And at the top are assets like property, because it is easier to turn your equipment into money than it is to sell property.

You can see here that your balance sheet total has not changed. You have simply exchanged one type of asset for another. In accounting terms, this is called an active swap.

Next Steps

Your business is now ready to start. You have the equipment you need to become the next TikTok star and make the big bucks.

Not only that, but you now know all about balance sheets and accounts, because you have now seen all five types of accounts and where they appear on your balance sheet and profit and loss statement.

Armed with the basics of double-entry accounting and how to do it easily in Numbers, you are ready for some more advanced applications.

In the next article, you will learn how to use your spreadsheet to make predictions about your financial future and your business.