This is the second article in my series on using spreadsheets to manage your personal finances. In this part I will show you how to create your own balance sheet. At a glance, the balanche sheet will present all the information about your current financial situation.

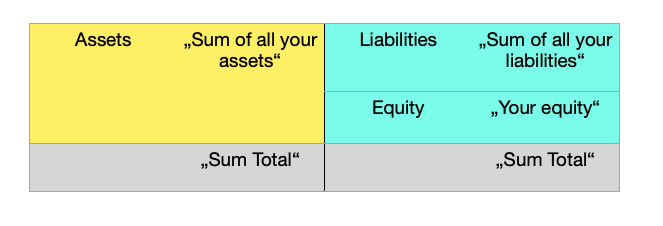

What is a balance sheet? It is a chart that shows you everything you own (your assets) on one side and everything you owe someone else (your liabilities) on the other. Both sides have to be in balance, which means that the sum of both sides should always be the same. This is where it gets its name from.

But wait, do they have to be equal? Usually they are not the same, you want to own more than you owe someone! What is the difference? The difference is called equity in business terms, or in your personal finances you would call it your net worth.

Equity goes on the right side of the balance sheet, so the rule is:Assets = Liabilities + Equity

This is just a restatement of the common sense definition of your equity (or net worth):equity = assets - liabilities.

The abstract form of a balance sheet looks like this:

As I mentioned, the “Sum Total” on both sides must always be the same.

The left side of the balance sheet is also called the “active side”, the right side is the “passive side”. The assets are the capital you actively work with, the liabilities and your equity are not meant to be actively worked with, but to get an overview of where the money came from (other people or your own equity).

The Balance Sheet of a Kid

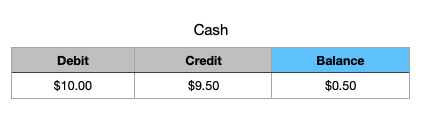

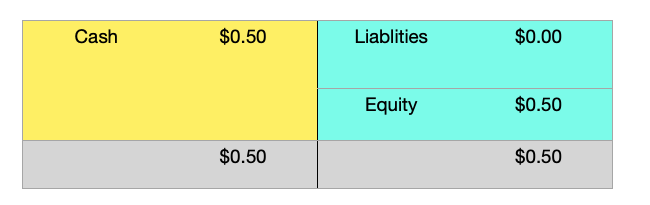

Let’s return to the example we started with in the first part of this series. In this scenario, you are a kid with a cash account and income from your parents’ allowance. At the end of the first week, you had $.50 left in your pocket. The cash account had a positive balance of $.50.

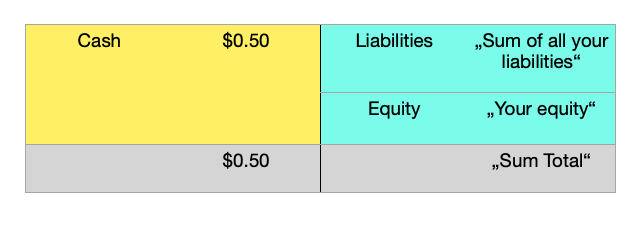

We know this is an asset account, so we can put this on the left side of your balance sheet:

What is on the right? You have no liabilities (yet), so there is only equity. According to our rule, your equity is the difference between your assets and your liabilities, so a total of 50 cents.

This completes your first personal balance sheet!

Well, not quite yet. By filling in the equity side of your balance sheet just like that, we have broken one of the basic rules of double-entry accounting. The rule is that everything is an account.

This rule also applies to the equity side of your balance sheet. For your books, this means that you need to create another ledger account for equity.

For the balance sheet to be in order, this account must also have a balance of $.50.

The question is, how do we get there? The short answer is: We need to make some entries to this account. But which account do we book to?

We need to go into more detail and introduce another account first: The Profit and Loss (P&L) account. The P&L account is a double-entry accounting construct that adds up all the increases and decreases in your equity. Using the profit and loss statement, you can check if your total equity has increased or decreased during the period you are considering.

Closing the books

As a first step, we need to make the entries to the P&L account. An accountant in a company would do this when the company prepares its balance sheet, at the end of the year. But we are free to do this whenever we want to have an up-to-date view of our finances. So let’s do it right now and let’s say we want to create your balance sheet at the end of the current month (June 2023).

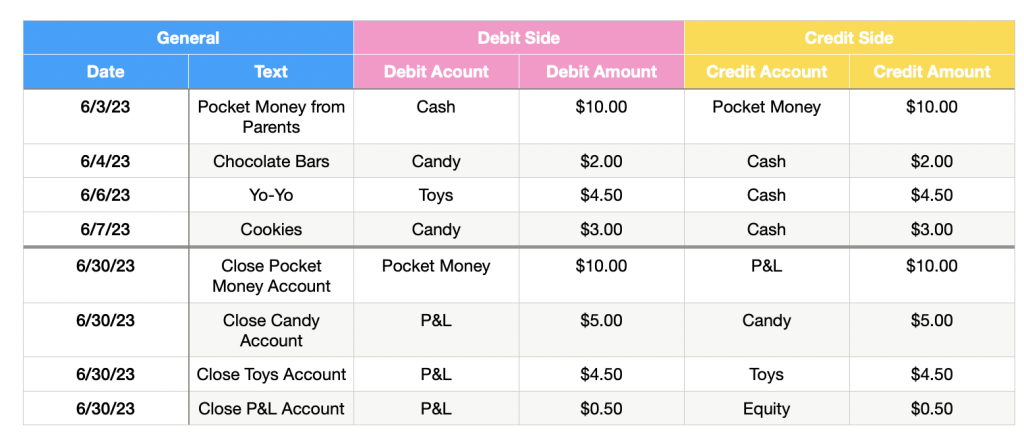

Your entries would look like this:

To do this, we need to book all of your income and expense accounts against the income statement. This is called “closing an account”. This is done by offsetting the balance of the Income and Expense accounts against the Profit and Loss account.

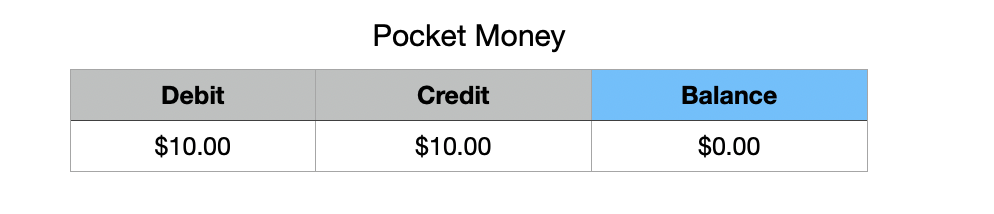

You can see that for the pocket money account, your only income account, the profit and loss account appears on the credit side.

Thus, the entries for the Pocket Money account are on the debit side, and this has the effect that your Pocket Money account is now in perfect balance:

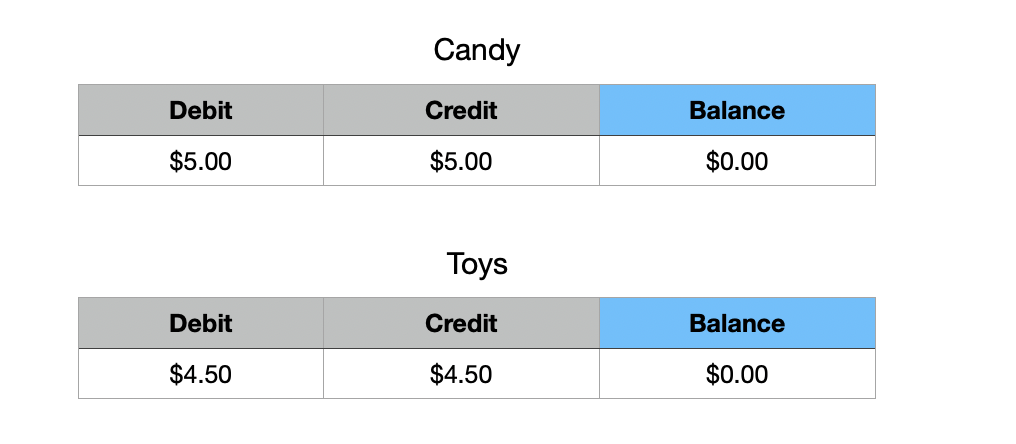

The same goes for your two expense accounts, Candy and Toys. Only compared to the income accounts, the debit and credit sides are now reversed. Now they are balanced as well:

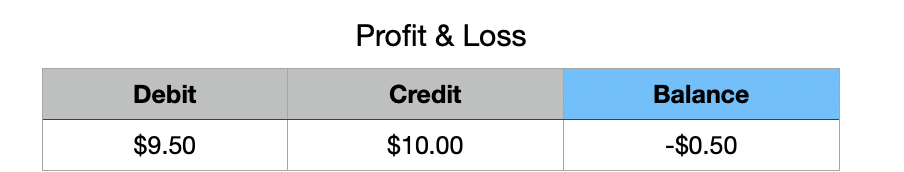

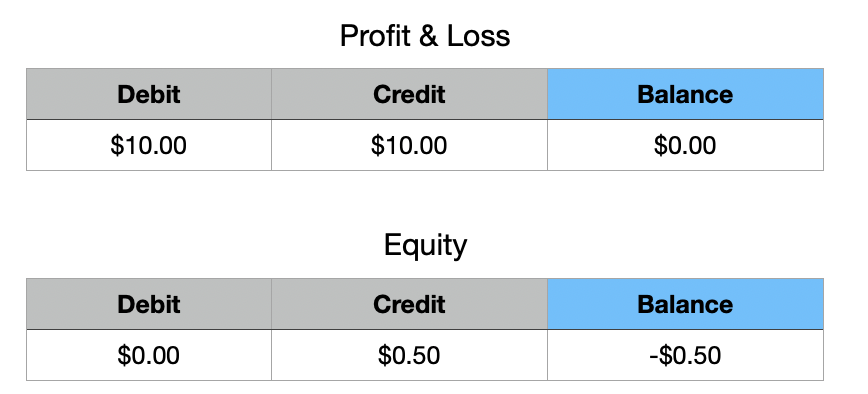

After this step, all your income and expense accounts should be in balance. Now the profit and loss statement looks like this:

You can see that the balance is negative: -50 cents. But don’t worry, a negative balance is not necessarily a bad thing. As I mentioned in the previous article, the sign is a result of the convention of always subtracting the credit from the debit. And credit and debit have no fixed meaning. You have to know how to interpret this result, and in the case of the P&L account, a negative sign means a profit.

The final step in calculating your equity is to close the P&L account by offsetting it against the equity account:

This brings us to the final balance of the equity account:

As you can see, the P&L account is balanced (aka closed). The equity account balance now shows your equity. It is 50 cents, just as we calculated in the beginning.

Summary

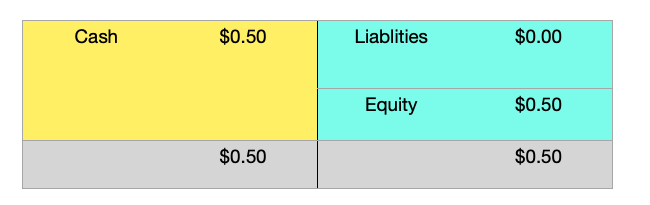

Now that we have shown that all of your accounts are in order, let us take another look at your balance sheet:

We had to take a little detour through the concept of closing accounts and the profit and loss statement to show that this balance sheet is correct.

Now that we are done with the formalities, we can make the balance sheet more interesting. In the next chapter we will add more interesting accounts, such as liabilities and other types of assets. Then you will get an idea of how all this can be applied to your own finances.

Stay tuned!